Are you striving to climb the credit score ladder, but finding it slippery? Experian Boost offers a compelling solution, potentially transforming your everyday bill payments into a springboard for credit score enhancement.

In a financial landscape where a strong credit score unlocks opportunities, the ability to leverage existing payment habits to your advantage is a significant advantage. Experian Boost is designed to do just that, offering a straightforward way to incorporate positive payment history into your credit file. The premise is simple: by adding your consistent, on-time bill payments to your Experian credit report, you can potentially boost your credit score. This tool is particularly beneficial for those with "thin" credit files or those seeking to improve their credit standing. The system works by analyzing your online banking data, identifying timely utility payments, and adding them to your credit history. This can lead to an immediate positive impact for many users.

The impact can be substantial. On average, users who have seen an increase in their FICO Score 8 from Experian have seen an increase of 13 points. Experian Boost offers the potential to increase your score to a maximum of 999, or a perfect score. The potential to give your credit score an instant lift through your existing habits of paying bills is a major advantage.

The type of bills that qualify for Experian Boost include essential utilities, such as electricity, water, and gas, as well as cell phone bills. Furthermore, online rent payments are also considered, offering a comprehensive scope of bills that can contribute to a positive credit history. These bills must be paid on time and in full in order to be counted towards your credit score.

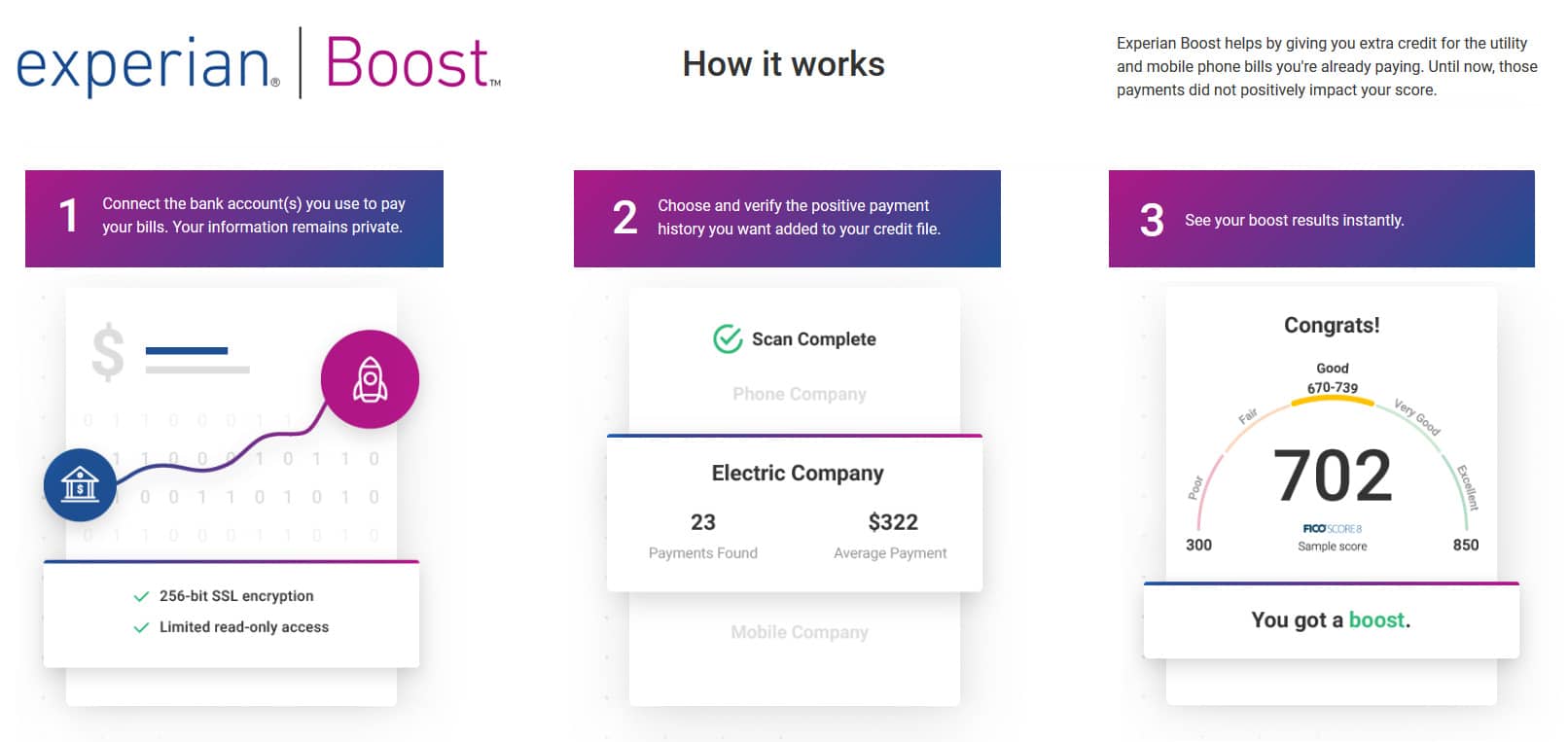

How does Experian Boost work? The process begins with your bank account, the same account you use to pay your bills. The system then scans your payment history, looking for qualifying bills. To be eligible, you must have made at least three payments in the last six months, with one payment within the last three months. Experian Boost searches through up to two years' worth of account history to identify eligible bill payments. Experian makes it quick and easy to remove an account anytime you wish. The entire process is designed to be user-friendly and efficient. Once you link your bank accounts, you can select the payments and bills you want to include in your Experian credit profile. By adding those bills, you are taking a proactive step to improve your credit score.

A key factor in calculating your credit score is your payment history, constituting a significant 35% of your score. In fact, timely payment history is a key factor in keeping your credit scores low, while late payments or missed bills can negatively impact your score. Experian Boost leverages this fundamental principle by recognizing your responsible payment behavior and integrating it into your credit file. The system works by adding positive payment history from everyday bills to your credit report.

The following are the utility bills which are eligible for Experian Boost:

- Mobile and Landline Phone

- Internet

- Utility bills (electric, gas, water)

- Residential rent with online payments

You can select which bills to add to Experian Boost. You can choose to link up to two years of payment history for any qualifying bills. It takes about five minutes to complete the whole process and you'll see any changes to your credit scores instantly.

One of the most attractive aspects of Experian Boost is its accessibility. It's a free feature, and so is the basic Experian account required for Experian Boost access. Experian Boost is a free service designed to help you raise your credit score by incorporating more of your monthly payments into your credit file. A premium membership is available for a fee, with expanded benefits including access to credit reports and FICO Scores based on data from all three national credit bureaus, but it is not required for Experian Boost. With Experian Boost, youll get credit for timely payments made to qualifying utility, streaming service, and cell phone providers. Some of the more popular service providers include AT&T, Disney+, HBO, Hulu, Netflix, Spectrum, and Verizon.

Signing up for Experian Boost is designed to be quick and easy, potentially leading to an increase in your FICO Score 8 based on Experian credit data. Once the accounts are linked, Experian Boost will look through your payment history for any qualifying bills that have at least three payments in the last six months, including one payment within the last three months. When your Chime account is connected to Experian and you use Experian Boost, you may be able to improve your FICO score simply by paying your bills on time.

Experian Boost is designed to help those with "thin" credit files (or poor credit) to beef up their credit history and improve their scores. This service adds more data to your history to bulk up your credit file with positive payments, which can improve your credit score.

Experian Boost makes it quick and easy to increase your FICO score based on Experian data by recognizing your history of paying recurring expenses such as phone and utility bills, streaming service subscriptions, and online rent payments. Once you hit the continue button, the screen will load, and then you will know Experian Boost added points to your FICO score.

If youre looking for a way to boost your score, Experian Boost claims they can use your regular bills (including rent) to improve your situation. In many instances, users find their scores improve immediately. Your new credit score will be available for lenders when you apply for any new credit products. If they qualify, boost adds them to your Experian credit file potentially raising your FICO 8 score.

Experian Boost is a useful tool to build your credit. When your Chime account is connected to Experian and you use Experian Boost, you may be able to improve your FICO score simply by paying your bills on time.

This points boost is then added to your Experian credit score, providing the potential to increase your score to a maximum of 999 or a perfect score. Experian Boost is a service that uses alternative credit data, including payment history from participating service providers, to raise your credit score.

Learn more about Experian Boost, which promises to help you increase your credit score by taking a look at your bill payments via a bank account.